Biden Administration Suggests Medicare and Medicaid Include Expensive Weight Loss Medications

On Tuesday, the Biden administration put forth a proposal aimed at allowing Medicare and Medicaid to include coverage for weight loss medications intended for individuals suffering from obesity.

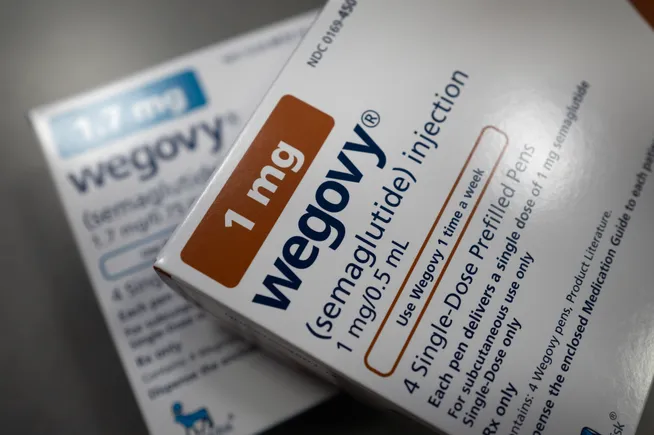

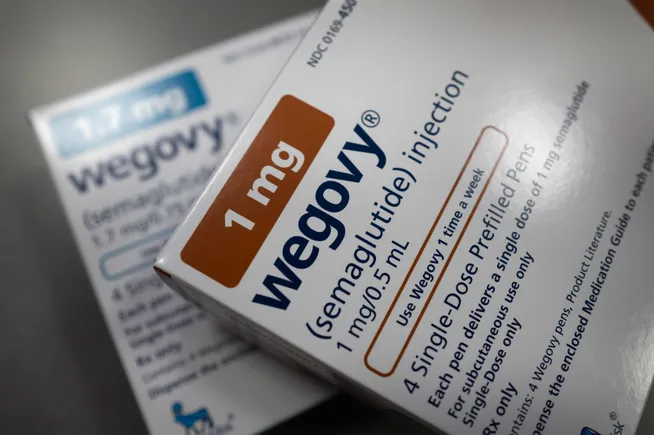

If maintained by the forthcoming Trump administration, this new rule could greatly enhance the accessibility of drugs like Wegovy and Zepbound, both of which have demonstrated significant effectiveness in weight management. However, this increase in coverage is projected to incur an expense of around billion over a decade for both federal and state budgets.

Currently, Medicare has legislative restrictions preventing it from covering weight loss medications, and only a limited number of state Medicaid programs have this coverage in place. Chiquita Brooks-LaSure, head of the Centers for Medicare and Medicaid Services (CMS), emphasized the importance of providing affordable medication access for individuals with obesity during a press call.

According to the CDC, over 40% of the U.S. adult population is classified as obese, a figure anticipated to climb to 50% by 2030. This condition can exacerbate a range of severe health issues, including heart disease, diabetes, and strokes, and is often resistant to traditional weight loss methods.

GLP-1 agonists, a class of medications, have seen increased utilization in recent years due to their efficacy in treating obesity, with users reportedly losing 15% to 25% of their body weight. These drugs mimic hormones associated with food digestion and have been linked to reduced risks of heart-related complications.

Despite the high demand, affordability remains a major hindrance for many people. Drugs like Wegovy and Zepbound come with annual list prices exceeding ,000; however, both Novo Nordisk and Lilly have programs to help decrease costs for some users.

Employer-sponsored health insurance plans are also wary of covering GLP-1s due to their high expense, with fewer than 1 in 5 providing such coverage this year, per KFF data.

For the 72 million Americans on Medicaid, the availability of anti-obesity medications is inconsistently applied, with just 13 states approving GLP-1 use for weight loss.

Moreover, numerous individuals enrolled in Medicare have not been able to access weight loss drugs since a ban was enacted about 20 years ago. Earlier this year, CMS initiated some coverage for Wegovy in certain cases, specifically for Medicare participants suffering from obesity along with heart disease.

To work around these existing legal barriers, regulators aim to modify how the law is interpreted, categorizing obesity as a chronic disease rather than merely a weight concern.

The reevaluation is driven by evolving medical understanding regarding obesity, as articulated by Meena Seshamani, Medicare’s director, during the media briefing.

This proposed regulation would potentially provide medication access to approximately 3.4 million Medicare beneficiaries and 4 million Medicaid recipients, as indicated in a White House fact sheet.

Eligibility for these medications would be determined based on a body mass index (BMI) of 30 or greater, explicitly excluding those with only mild overweight classifications.

The proposal also modifies Medicaid rules, ensuring anti-obesity drugs are no longer excluded from the safety-net program.

The potential popularity of this measure is highlighted by CMS’s expectation that it won’t lead to increased premiums or out-of-pocket costs for beneficiaries, a notion reinforced by consumer protection elements present in the Inflation Reduction Act of 2022.

Quantifying the financial aspects, officials suggest that current GLP-1 users might see their out-of-pocket expenses reduce significantly—possibly by as much as 95%.

Nonetheless, the financial implications for taxpayers are substantial, with projections indicating that Medicare could allocate about billion towards weight loss drugs over a decade, further straining an already challenged program.

In addition, expected costs for Medicaid are estimated at billion over the same time frame, while states would incur roughly .8 billion, per Medicaid administrator Dan Tsai.

Uncertainties remain regarding state responses to this proposal, particularly given that Medicaid often represents a top budget expenditure.

Among states that currently do not provide this coverage, only half indicate consideration for its implementation, with cost being a significant concern, as indicated by a recent KFF survey.

Tsai recognized that financial pressures on states are considerable, which is why the federal government plans to take on a substantial portion of the cost for these drugs. Input from states regarding the proposal and its implementation timeline has also been solicited.

Key issues yet to be clarified include whether the expanded coverage would encompass just branded medications or also include compounded alternatives, which pharmaceutical companies have contested; as well as how the surge in demand for weight loss medications will be addressed amid existing shortages.

Facilitating GLP-1 prescriptions for Medicare and Medicaid populations is likely to positively impact pharmaceutical companies like Novo Nordisk and Eli Lilly, with their stock values reflecting a boost following the announcement.

If finalized, this rule could also have consequences for chronic care management firms and telehealth businesses that are developing services around these medications.

On the other hand, payers might experience more complex consequences, notably as they typically align their coverage decisions with Medicare and could feel pressured into including GLP-1s, despite financial implications. This concern especially pertains to Medicare Part D plans from companies such as UnitedHealth, Humana, and CVS.

Ultimately, the future of this proposal hinges on whether the incoming Trump administration opts to uphold it. Due to required regulatory processes, CMS will be unable to finalize the rule before President Joe Biden’s term concludes in January.

Trump’s anticipated nominees for Health and Human Services and CMS showcase divergent perspectives on GLP-1s. Robert F. Kennedy Jr., expected to be nominated as HHS secretary, has expressed skepticism towards these weight loss medications, suggesting that improving access to nutritious food could be a more economical solution. In contrast, television personality and physician Mehmet Oz, a suggested nominee for CMS administrator, has publicly supported GLP-1s.

A bipartisan movement exists within Congress to repeal Medicare’s prohibition on weight loss drug coverage, although efforts to advance this legislation have stalled.